President Trump Offers A New Bout Of Inflation...' er Tariff Dividend

It’s an almost irresistible temptation, especially for Americans who are suffering financially: President Donald Trump has offered to send out a “Dividend” Check to millions, promising it is part of the very successful Tariff Program. Today, we’ll take a look at this offer and decide whether it is a “good deal.”

Before we look at the economic and financial implications of these checks, it’s important to note that it’s no accident that this offer is made just as the Supreme Court is deciding whether Trump’s Tariffs are legal. It’s also the time when a Government shutdown reduces SNAP and other food payments to recipients. $2,000 would go a long way in offsetting that restriction.

Without a doubt, this “Tariff Dividend” is a shrewd political move that will likely sway the financially naive to see things Trump’s way. However, as monetary economist Milton Friedman was fond of saying, “There’s no such thing as a free lunch.” Although the idea of a dividend sounds enticing, it is, at the very least, a distortion of America’s financial condition.

A quick look at the US Income Statement shows we spend more each month than we receive in income, creating an enormous deficit that grows daily. The very idea that we would send out billions of dollars in the middle of an already existing financial crisis is reckless to say the least. Combining these Tariff Checks with an already existing massive Budget Deficit is financial mismanagement of the highest order.

But it’s much more than that; it’s deception. The very citizens who will probably see this as a financial lifeline are also the ones most likely to suffer the consequences. You see, the price for these checks comes later and will be paid back by all of us over time.

What President Trump is offering is nothing more than the same playbook he began back during the COVID-19 Pandemic. As you recall, Trump then offered a stimulus check to all taxpayers, one ostensibly designed to aid us through the financial crisis caused by the lockdown of the economy. Like today, times were tough for many Americans, sent home from their jobs, they faced the decline or even elimination of their wages and salaries. In response, Trump sent out “free” money. Only it wasn’t really free, and it wasn’t really Trump’s to send out.

On the surface, it was a simple mechanism, reinforced by the mainstream media’s portrayal of the process. From television news to online websites to newspapers, their discussion focused on how the funds would reach individual citizens. Would checks be mailed? Or funds deposited in your bank account? How much would each household receive? And when would the funds reach you?

All important news for those who were desperate to pay their bills, and thereby make ends meet. But this was far from the whole story; in fact, it deceived many into believing that this was all there was. That the Government, through the generosity of the President, had come to their rescue. Again, this was pure financial deception.

What happened behind the curtain tells a very different story. The reality of those generous stimulus checks was that before the first check reached the taxpayers, the money had to be created by the country’s central bank. The Trump Administration first went to the Federal Reserve, projecting how much “stimulus” they would send.

Note: Although the first round of stimulus checks was sent out by then-President Trump 1, stimulus checks #2 and #3 were sent out by the newly elected Biden Administration.

Together, first the Trump Administration and later the Biden Administration, devised a plan whereby the Federal Reserve would loan money to the Government, which, in turn, would send out those checks. At its peak, the Federal Reserve expanded its total lending to an incredible $9 trillion.

Just like that, America was living off its credit, borrowing money from the future that would someday have to be paid back, with interest, to the Federal Reserve.

What’s more, all of a sudden, cash was plentiful. Our bank accounts reflected this incredible largess. We had money to spend, as did everyone else, and things looked rosy. Stimulus looked like the best idea since sliced bread.

Few saw that another shoe was about to drop, that the “free” Government Check wasn’t really “free.” That extra money — those dollars that filled our checking accounts — wasn’t the same as the old dollars before the stimulus. When the Fed loaned those dollars to the US Government, it did so by creating new dollars — stimulus dollars, if you will.

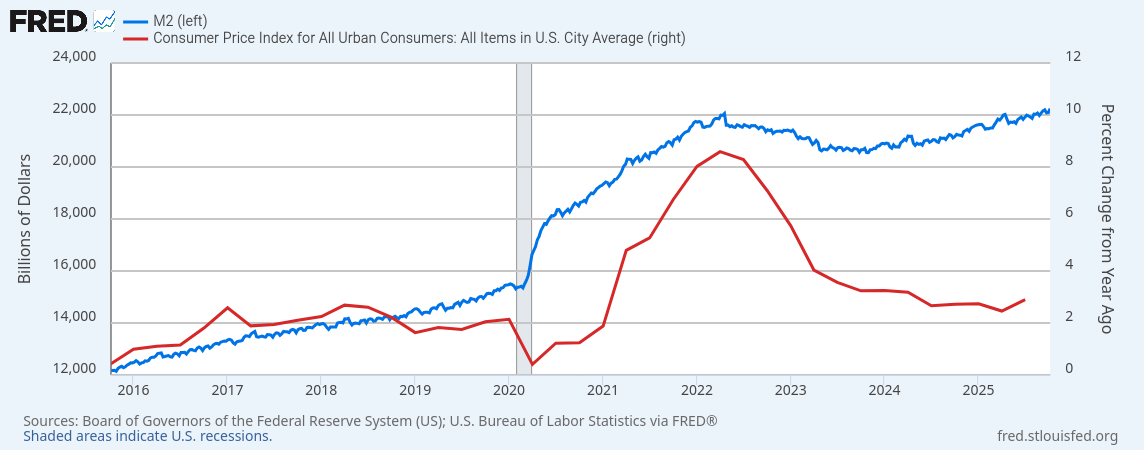

Economists carefully monitor the number of dollars in our financial system; they call it the Money Supply. While there are several ways to measure money, today we’re looking at M2 Real (after inflation). Using this measure, we see that the money supply expanded from $15 trillion before the Pandemic (2019) to $22 trillion after (2023), a nearly 50% increase.

As any first-year economics student will tell you, excess supply means a lower price. In other words, after the stimulus pushed up the number of dollars in circulation, each dollar would buy less than it did before the stimulus. Another way to say this is that the price (in new stimulus dollars) of all the goods and services we purchase rises. In other words, inflation. Rising prices due to the increased supply of dollars.

Bingo, that’s just what happened in the months since the stimulus checks were issued. By giving “free” money to Americans, the first Trump Administration had created the high inflation that has haunted us ever since. Fortunately for Trump 1, another Administration, Biden’s, would suffer the consequences. But make no mistake: expanding the money supply as dramatically as we did during COVID will inevitably affect inflation.

That’s what President Trump is promising to do again. Once again, giving free money (the Tariff Dividend) and hoping no one notices the inflation to follow.

For more articles like this, follow me here on ValueSide.