The 2025 Macro Outlook, Three Things To Watch Out For

In 2024, the overall Economy took a negative turn in three areas critical for investors: Corporate Profits, the country's financial condition, and retail sales. Although each sector remains positive, it has taken on a decidedly negative direction.

I'll be utilizing the data from the Bureau of Economic Analysis's latest release on the Gross Domestic Product (GDP). You can find the release here: https://www.bea.gov/data/gdp/gross-domestic-product.

The Decline In Earnings Momentum

If there is one indicator that investors ought to focus on, it is Corporate Profits, known to investors as "Earnings." From a "fundamental" perspective, earnings drive the share price. In a positive economic cycle, the rise in earnings powers a Bull Market, such as we've experienced for the past couple of years.

Suppose you've been listening to Wall Street's recent market projections for 2025. In that case, corporate earnings are always at the very top of the indicators they point to as signaling another stellar year for stocks. And corporate earnings in 2024 indeed hit another record high, and that's a very good thing.

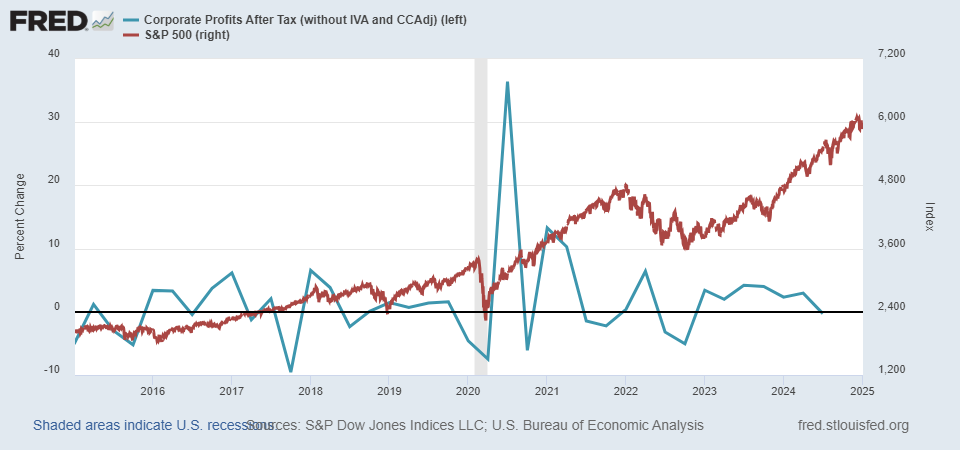

This Chart shows thePercentage Change in Corporate Profits.Notice the big jump in Profits during Stimulus. Subsequently Profit Growth has slowed dramatically, the most recent shows a decline in Profit Growth. Note how the Stock Market ignored the declining Profit Growth Momentum.

**

However, what most have missed is that earnings have lost their momentum. In fact, the percentage change in corporate earnings turned slightly negative in Q3 2024 (the latest data we have). So, while earnings remain positive, the rate of increase has slowed dramatically.

As we delve even more closely into the data, we'll note that in two of the three reported quarters, Corporations had negative earnings, a situation where costs exceeded income. This can be due to many factors, such as supply chain issues, out-of-balance inventories, or poor sales. But whatever the reason, Corporate Earnings are not as robust as Wall Street and many investors suppose.

Adding the market's perspective to our discussion, note the recent behavior of the S&P 500 (red line). Wall Street has entirely ignored this loss of earnings momentum. This is mainly due to the sterling performance of those large-cap Magnificent Seven Stocks, including companies like Google/Alphabet, Microsoft, Apple Computer, and, of course, Nvidia.

While investors may wish that these seven stocks comprised the entire market, unfortunately, that is not the case. What's more, if history is any guide, these top seven are as vulnerable to any major market downturn as the rest of the market. Look at the behavior of companies like RCA and the Rail Roads (the darlings of that era) back in the Crash of 1929; they fell along with the rest of the market.

The other reason the market seems to have ignored this decline in Earnings Momentum is the confidence that the Federal Reserve will manage the Economy so as to avoid any bad times. The perception is that the Fed got us out of the COVID-19 Crisis and will do it again if necessary.

Current Financial Conditions

Remember back to the COVID-19 Crisis? It was a miserable time for all of us and especially traumatic for our Economy. Non-essential, so-called businesses were closed, workers were urged to remain at home, social distancing became the norm, and the economic impact was profound. That dreadful second quarter of 2020 saw the worst economic performance in history! Annualized, our nation's GDP fell by a devastating 30%, worse than the Great Depression (although the Great Depression continued its decline for much longer).

For the Federal Reserve, it was all hands on deck, as new and untested strategies and techniques were used to bring the country out of its economic tailspin. Many highly technical tactics to keep the banks afloat were implemented, which we won't have time to discuss here. But there were two principal strategies that the Fed used that we all saw and benefited from.

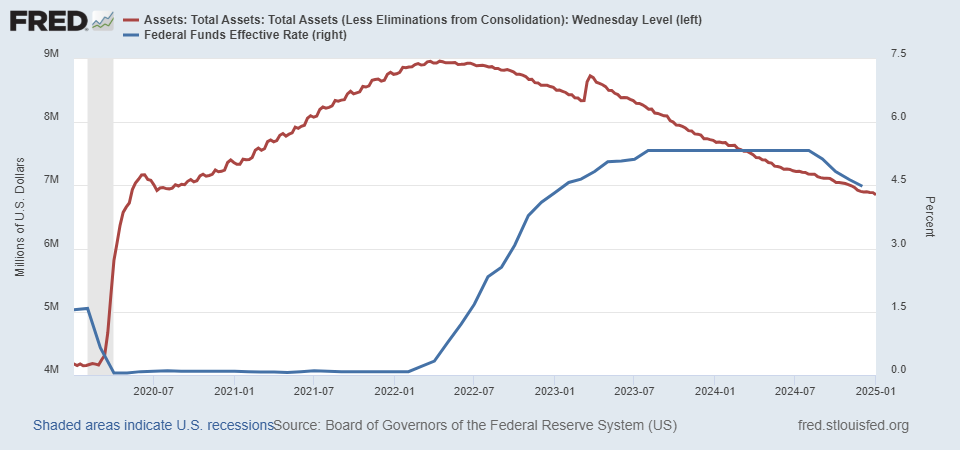

Fed Balance Sheet (red, right scale) dramatic growth during stimulus ($4.5T to almost $9T), currently being reduced. Fed Interest Rate Policy (zero to 5.5% to 4.5%).

**

The Fed's first strategy was to reduce interest rates to essential zero. The Fed had tried to raise interest rates to a more normal level for the four years prior, but the COVID Crisis caused them to return to a ZIRP (Zero Interest Rate Policy).

Unfortunately, for most of my friends in the investment world, that's as far as their memories go: "Fed Interest Rate Policy." So, almost all of the discussions today focus on Interest Rates. If the Fed just eases Interest Rates, then everything will be just fine, goes their thinking. What's more, with the Fed's latest rate cuts, financial conditions must be positive, and there's nothing to worry about from a financial view.

Not so fast. Remember, the Fed utilized another primary strategy to get us out of the COVID-19 hole. Economists called it "Quantitative Easing," but you and I remember it as those wonderful "Stimulus Checks" that showed up in our bank accounts. It seemed like "money from Heaven."

But it wasn't from "Heaven" at all. It was a significant strategy of the Fed. The mechanics behind all this are straightforward – the Fed bought a ton of US Treasury Securities (Bonds, Notes, and Bills). By "ton," I mean nearly $5 Trillion worth of US Treasuries, which reside on the Fed's "Balance Sheet." Their thinking was that by putting that money into the Financial System, they would start a positive cycle, where banks would be anxious to lend out those funds, and people once again spend – put money into the Economy when times were tough and take it back out after the Economy recovered.

The Stimulus part of this strategy ended in Q2 2022, the last time the Fed added funds to the Economy. Since then, the Fed has been systematically withdrawing money. Mechanically, they've been selling their bonds, retiring them, and taking money from the purchaser (Big banks and brokers who make up the Primary Dealers). In the two and a half years since the Fed went from Quantitative Easing to Quantitative Tightening (although the Fed wouldn't use that term), they've removed roughly $2 Trillion from the Economy, not an inconsequential number.

Combine the Fed's due bill of roughly a trillion dollars each year with interest on our national debt of another trillion, and you'll see how 7% of our country's GDP is being used for debt service. Before an American Factory can make the latest widget or a Consumer can purchase the newest gadget, our nation's interest has to be paid – at least $2 trillion comes out (theoretically) of the country's income (GDI). This is about as far from an "easy" financial environment as I can imagine. And it is being ignored by Wall Street, which must feel that these interest payments don't apply to their "Magnificent" stocks.

The Resilient Consumer

The one real bright spot in the Economy has been the resilience of the American consumer. Through thick and thin, Americans continue to purchase at a rate that makes the Economy hum. You've no doubt heard that about two-thirds of all economic activity is generated by the consumer. Consumerism is the engine that powers our Economy.

But recently, times have gotten tough for the American consumer. The worst inflation in a couple of generations means that it takes more to provide the same standard of living as four or five years ago. Today, prices are higher across the board, especially in such necessities as food, shelter, and energy.

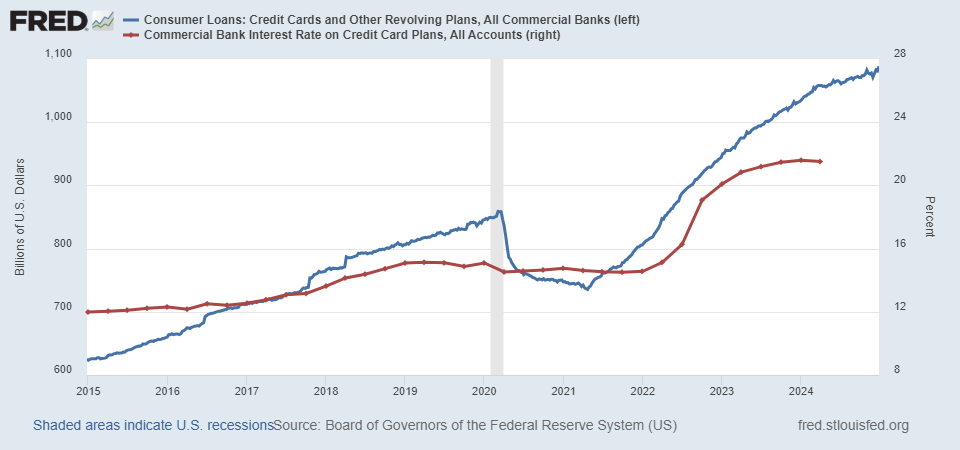

Outstanding balances on revolving credit (credit cards) (blue, left). Credit Card Interest Charges, Major Banks (red, right). Higher balances combined with higher rates, a double whammy for the consumer.

**

Many have met these escalating costs by increasingly purchasing on credit. In the summer of 2023, we surmounted $1 trillion in revolving debt (credit cards and lines of credit) for the very first time. That's not a good trend, but it's been made much worse by a dramatic rise in consumer credit costs, which include both interest and fees.

Although we don't have the data on Credit Card Fees, we know that the average interest rate charged on Credit Cards from major banks is up by nearly 50%, from 14.5% to 21.5%, adding an additional burden to consumers. But it doesn't stop there; as we noted in a recent article, it's the specialty cards, cards with enticing initial low interest rates, store cards, and affinity cards where you find the staggering interest charges. It's not unusual to find a card that charges more than 30% in these "special' credit cards.

Although, as we noted, for now, the American consumer is extremely resilient, able to meet today's financial challenges and still provide their family with a stable lifestyle. However, subtle cracks are beginning to appear. Recently, "Charge-Off" rates for the major banks began to rise. A charge-off is when a creditor has been unable to pay their bill, and the bank has been unable to collect, so the bank "charges off" any remaining balance. It's the final step of a long, drawn-out process that often involves bankruptcy for the borrower. In Q2 2024, the "Charge-Off" rate for the major banks reached 4.75%, the highest level in 13 years.

Conclusion

Consider this the "rest of the story," as Paul Harvey used to say, to the often overly optimistic projections we hear from Wall Street. While 2025 may be the third sparkling year in a row for investors, it will not come without some challenges. Our nation faces some difficult choices regarding our personal and national finances. Without a doubt, the country's balance sheet needs to be reined in. Like a consumer in a structured recovery program, we must find a way to lower expenses or raise income. Hopefully, we can do both.

This is certainly not the "end of the world as we know it," but it is also not the overly optimistic future that some have envisioned. Hopefully, we can have a realistic view of 2025, one that includes both our challenges and our opportunities.