There Is A Cancer Eating At Our Economy, But Does Washington Get It?

Imagine a situation where nearly four cents of every dollar you earn is taken away, charged as a tax, yet contributes nothing. As a citizen, this charge provides no services, no schools, no national defense, no social services; in the words of economist Lacy Hunt, it is simply a "dead weight loss."

The expense we're talking about is the interest on our national debt, a charge that now exceeds one trillion dollars per annum. It is all part of an interlocking, complex web of encumbrances that saddles every man, woman, and child in America.

It's also the flash point that ignited one of the most public spats in the new Trump Administration. Undoubtedly, you are aware of Elon Musk's storming out of the White House. In an altercation fought mainly through their respective social media platforms, Musk owns "X" (formerly Twitter), Trump owns Truth Social, each was called names, accusations were made, and a level of pettiness reached that we've seldom seen in the upper echelons of Government before.

But setting aside the personal pettiness, at its heart was Musk's reaction to the "Big Beautiful Bill," President Trump's Budget for the next fiscal year. The Congressional Budget Office (CBO) projects that this new bill, packed with substantial additional spending, will add $1.865 trillion to next year's deficit, and up to $4 trillion to the deficit over the next decade.

Interestingly, the CBO's projection is very optimistic in considering economic growth. The CBO assumes that the economy will grow at a 1.8% rate over the next decade. This is important, as more economic growth means higher tax revenue, and thereby reduces government debt.

But the latest report on the nation's economy (GDP) shows that the economy shrank by 0.5%, and historically, any economic activity at this level would profoundly add to the Government's deficit. You see, to boost the economy, the Federal Government continues its spending level even though tax revenue declines, creating much greater deficits.

So, we're beginning to see just why Elon Musk was so upset. After all, he came to Washington expressly to curtail government deficits, to lower this unbridled spending. And President Trump has just rolled out the largest budget in history in total disregard for the nation's debt problem. To Musk, it must have seemed like all of that work over at DOGE (The Department of Government Efficiency) was in vain. In one fell swoop, Trump had just upped spending by multiple levels over what Musk had saved through his DOGE spending cuts. Talk about going in opposite directions.

For Musk, this must have been personal, after all, he had suffered severe blows to his reputation. As the point man for laying off hundreds of Federal employees, Musk has gained the animus of entire departments within the bureaucracy. What's more, political liberals felt that he had gone too far in reducing government services, and he was now feeling their ire. Incidentally, many of these people were Tesla owners, and they were upset that the CEO of Tesla would do such a thing.

None of this affected the President, who regaled all in the passage of his first significant piece of legislation. While the BBB (Big Beautiful Budget) may have achieved much of Trump's objectives, enhanced defense spending, benefits for specific industries and businesses, the chief attribute will have little or no effect on future economic growth.

President Trump noted the importance of extending the "Tax Cuts" initiated during his first Administration (the Tax Cuts and Jobs Act). Under the Tax Cuts and Jobs Act, which went into effect on January 1, 2028, individual tax rates for those who earned more than $9,500 per year were reduced, as well as certain additional deductions allowed. Additionally, there was a substantial reduction in the Corporate Income Tax Rate to a flat 21%.

While these lower rates needed to be extended, reverting to the older, higher rates would have significantly dragged on the economy. Moreover, maintaining a tax rate that has been in effect for seven years would provide no current boost in economic activity.

There is one point that the President makes that we need to take seriously. We began this discussion by noting Lacy Hunt's sentiment that interest on the national debt is an economic "dead weight loss," it contributes nothing to America's prosperity. Yet it costs over $1 trillion per year.

If there's one person who understands the "cost of borrowing," it's the President. After all, almost every building he has built has a mortgage, and the interest expense has been central to his success as a real estate developer. So, when he says that the Federal Reserve needs to lower interest rates, Trump is speaking as a long-term borrower; we ought to listen.

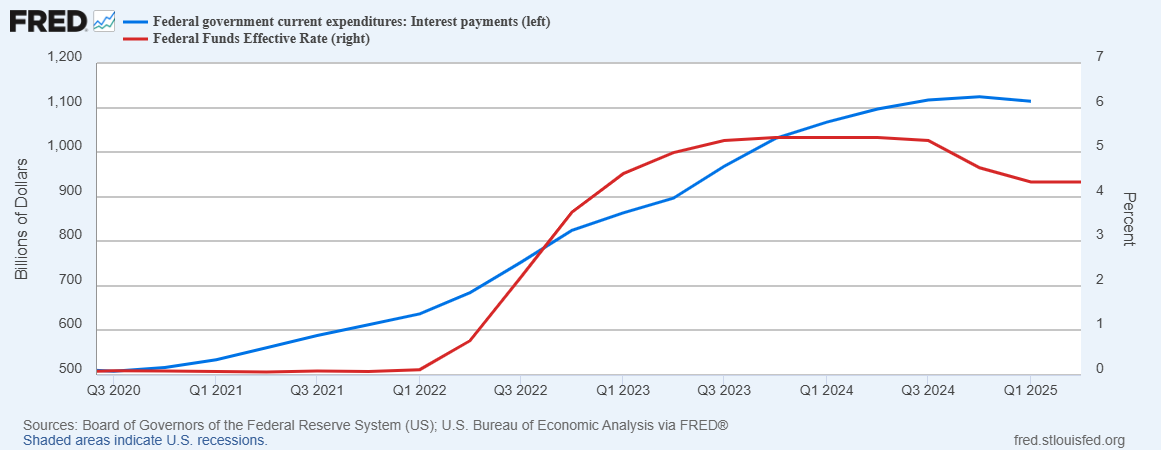

A quick "back of the envelope" analysis of the recent history of our national debt shows the incredible impact of the Fed's policy of higher interest rates. In Q1 2022, before the Fed started raising rates, our annual interest expense was $637 billion; today, our interest expense is, as we indicated, nearly $1.1 trillion, almost double the interest expense in just three years!

Why is this? Because the Federal Reserve raised its base interest rate (the Fed Funds Rate) from 0.12% to 4.33% (it was higher) – on a percentage basis, this is likely the most significant move in interest rates in our nation's history.

Today, we are continuing to live off the benefit of the Fed's lower interest rates. For two years (2020 – 2022), the Fed instituted what Wall Street called the ZRIP – Zero Interest Rate Policy – this meant that we could borrow with little or no cost. The Fed began raising interest rates in the second quarter of 2022, three years ago. Any T-bond or note with a maturity of longer than three years continues with that lower rate.

Over time, that lower interest rate will be replaced by a new prevailing rate as older bonds and notes are "rolled over." A quick calculation reveals that currently we are paying an overall rate of 0.30% on the Treasury's debt ($1.1 trillion interest expense on $36 trillion total debt). That rate has risen six basis points in three years and will continue to rise as old debt matures and is replaced with newer, higher interest rates.

The impact on US Treasuries, the Notes, Bonds, and Bills that make up most of our country's borrowings, has been substantial. Had the Fed maintained rates at the Q1 2022 level, we would be saving roughly one-third of our interest expense over these last three years.

Regrettably, the President has made his campaign for lower interest rates personal, aimed squarely at the Fed Chairman Jerome Powell. It's unfortunate because the argument for lower interest rates goes far beyond Chairman Powell. It goes to the very center of our nation's finances.

Although everyone won't be pleased with lower interest rates, savers in particular, of whom I'm one, would not welcome decreases in income from their savings. But as a way to climb out of the financial hole we find ourselves in, it's worth looking at all the alternatives. With an overall benefit measured in the hundreds of billions of dollars, we need to begin to look at unconventional methods, such as lowering interest rates, to reduce our country's financial burden.

Please follow me here at ValueSide.