Undoing The Economic Miracle

Our story begins in the dark days of the 1970s—difficult times, when a new phenomenon emerged, a circumstance that the experts believed impossible. The country fell into a vicious trap of both high unemployment and high prices. Economists had always thought that high prices were a sure sign of high demand, but that high demand was supposed to be driven by high employment, not high unemployment. We called this new phenomenon Stagflation.

You see, in the economist's perfect world — the one America was designed to replicate — it was consumers who set prices. And as more Americans had better-paying jobs, they would naturally be willing to "bid up" the cost of their favorite goods and services. It was "demand push" inflation.

What economists missed back then was that another entity had entered our market system —the Government. The Federal Government was rapidly becoming the biggest spender in the marketplace.

And there was one Government leader in particular, Lyndon Johnson, who had taken spending to a whole new level. Johnson thought that America could support both the Vietnam War and the most extensive social program in history, the Great Society.

The result was gigantic government deficits (sound familiar?), causing increasing depreciation of the US Dollar. It took more dollars to purchase the goods and services that Americans wanted. Or, from the customer's perspective, prices were rising, in other words, inflation.

So LBJ set the dismal 70s in motion with his "guns and butter" policies of the late 1960s, but it took two other Presidents to add to the nation's financial woes. Tired of the War, Americans elected Richard Nixon in 1968. And, like the present occupant of the White House, Nixon instituted a wide range of policies and initiatives, from workplace safety to international trade (which we'll address shortly) to, significantly, "wage and price" controls.

Why is it that so many of our Presidents come down with "Potomac fever" upon their election? The illusion that as President, they can solve all our problems. Well, Nixon had a full dose, and when he realized inflation was raising its ugly head, he immediately decided he could control prices and thereby eliminate inflation. Apparently, no one had told him that Johnson's overspending had created much of that inflation in the first place. (Side note: the OPEC oil Embargo didn't help matters either).

So now we had a fundamental "kettle of fish," a smelly situation where market forces no longer influenced prices (Nixon did that), creating massive imbalances between supply and demand.

America was no longer acting like the free-market capitalist society that we'd always been. Suddenly, we behaved like our arch-nemesis, the Soviet Union. And surprise, surprise, we would experience much the same problem that the Soviets endured: low productivity, high prices, and a discouraged populace.

Regrettably, the next President continued along the same playbook: increasing Washington's control over the economy. Jimmy Carter's plan to control energy costs was to drive more slowly and lower the heat in your homes—hardly a scintillating solution to our financial woes.

At last, it came to a retired actor from California to grasp the heart of the issue. Riding to the Presidency on the simple question: Are you better off today than four years ago? Ronald Reagan became the first President in 17 years to understand this basic principle of a free-market economy. Each consumer has to be free —free to choose (Milton Friedman) their purchases, while each producer/service provider also has to be free to set their price and thereby determine their profit.

It is this price freedom that allows the marketplace to reach equilibrium, yielding the best possible price. It is the genius of capitalism: the perfect balance of supply and demand that achieves a price that satisfies both the customer and the vendor.

September 29, 1981

"We who live in free market societies believe that growth, prosperity, and, ultimately, human fulfillment are created from the bottom up, not the Government down. Only when the human spirit is allowed to invent and create, only when individuals are given a personal stake in deciding economic policies and benefiting from their success -- only then can societies remain economically alive, dynamic, prosperous, progressive, and free."

Ronald Reagan— Remarks at the Annual Meeting of the Boards of Governors of the World Bank Group and International Monetary Fund

The Reagan Economic Miracle was freedom. As he was fond of saying: "Government isn't the solution; it's the problem. "By reducing the role of Government, Reagan was able to spur the economy to growth we hadn't seen in years. Although it wasn't easy, Reagan's first year in office saw a recession, but in the next seven years, America's GDP grew at nearly 4 1/2%, without further recession. It was a remarkable turnaround.

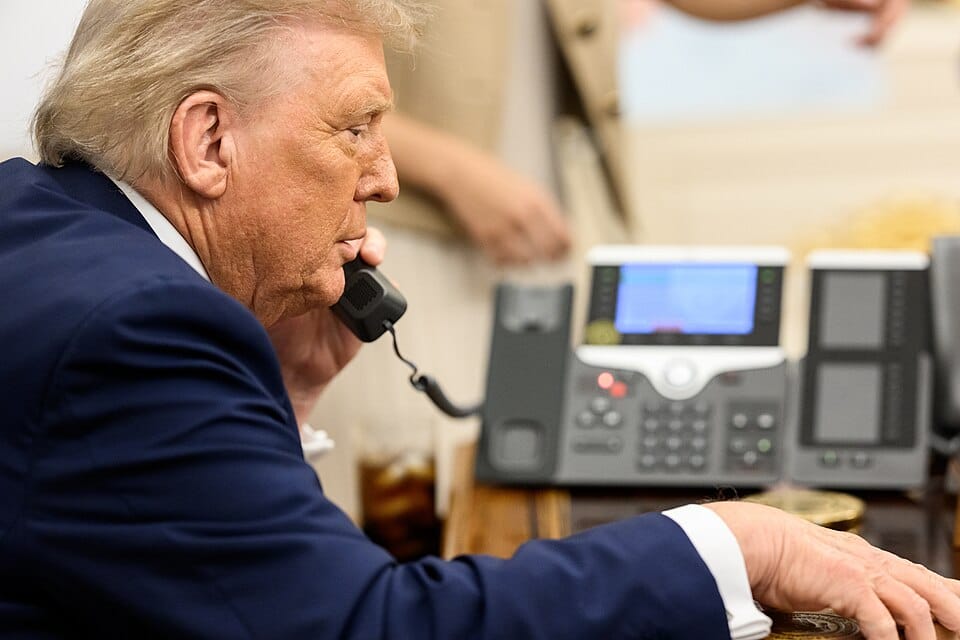

Today, we have another President who follows that long line of leaders who think they can solve all our economic problems. President Donald Trump has launched the most sweeping and volatile tariffs in our country's history, far above those imposed during the Articles of Confederation or the Smoot-Hawley Tariff of the 1930s.

Through the Trump Tariffs, he has set himself as the ultimate arbiter of import prices. Although many of these trade items pass through many hands — producer, import agent, rail and truck transportation, retail store — they must all conform to the latest iteration of Trump's Tariffs.

Making matters worse is the capricious nature of the tariffs; what may be settled today can change tomorrow if the President dislikes some aspect of the exporter's counter to American tariffs, or if our supplier takes some other geopolitical position. Recently, a television ad that Trump deemed offensive was enough to trigger a 10% increase in Canada's tariffs.

Apparently, Trump learned nothing from Reagan's use of economic freedom to build the economy, the subject of the Canadian commercial.

The US Economy is a massive force, expected to reach $30 trillion this year. Millions upon millions of Americans are involved in the production and consumption of the goods and services that make up that economy, with millions more involved in the international supply chain that provides additional components and commercial items used by assemblers and manufacturers throughout the nation. When analyzed properly, the price component of this economy is simply overwhelming.

No individual, no matter how well connected, can comprehend, much less direct, the millions of price decisions involved in its operation. The very thought that import tariffs (and therefore prices) can be adjusted at three in the morning, by one person, is absurd. But that's the situation we find ourselves in.

The damage being inflicted on our economic way of life and prosperity is staggering and will likely take years to unwind.

**

Follow me here on ValueSide for more articles like this.