Where To Stash Your Cash, The Warren Buffett Model

Cash management is a vital discipline on Wall Street. It's no place to let your money sit idle.

Recently, my sister-in-law asked for suggestions on where to place some extra cash. She wants to refrain from investing these funds, as she may need them in the future. So, where's a good place to put idle cash?

I get this question fairly often, and I'd like to explore this important component of most people's investment profiles.

Cash Management

Cash management is a vitally important discipline on Wall Street. It's no place to let your money sit idle, as those extra percentages you can gain by investing cash wisely can make all the difference in your long-term returns. And perhaps even more importantly, any cash investment gone wrong can tarnish a sterling reputation.

No one knows this better than Warren Buffett. After all, he's likely the most famous investor of our time and has been on Wall Street longer than most people have been alive. What's more, Buffett has accumulated the largest "stash of cash" in history. His holding company, Berkshire Hathaway, has an incredible $163 billion in cash in its latest annual report (for year-end 2023).

It's an unimaginable sum, made all the most so when you realize that only four banks in the country, JP Morgan Chase, Bank of America, Citibank, and Wells Fargo, have a net worth greater than that. And three of the four have recently been added to the FDIC's list of potentially troubled banks. Banks that the FDIC wants to change how they prepare for the next banking crisis. The FDIC has NOT said these banks are in trouble currently, but their crisis plan needs to be revised.

It's not something you and I have to worry about; we're covered by FDIC insurance. But for Buffett, this is a very big deal. His cash position must remain safe, and the only way for him to guarantee that is to hold cash at a safer institution than the nation's largest banks.

So, Buffett's only place for his cash is the US Treasury, where he has 80% of his cash holdings. (The other 20% is in various checking accounts, deposit accounts, and other accounts tied to his business activity.)

The Berkshire Annual Report tells us that all its cash is in "T Bills," US Treasury Bills. That makes sense because these are the shortest-term, most liquid Treasury Instruments.

T Bills generally mature anywhere from one month to one year. It's relatively easy to build a T Bill ladder of maturities. In a T Bill ladder, you divide up your cash into several different portions, investing each portion in a different month or quarter. Say you have $120,000 in cash. In a ladder, you'd put $10k in each month's T Bill (January, February, March, and so on). That way, you'd have one T Bill maturing each month. You'd then roll it over to the T Bill offering 12 months from now. Simple.

This gives you a steady stream of cash (T Bills maturing) and helps you ride the fluctuating interest rates up and down.

No doubt, this is the method that Buffett uses to manage his T Bill portfolio. And it's worked like a charm. Buffett has been accumulating his cash hoard for several years now. When he began T Bill, interest was only about 1/4%; today, interest on T Bills is nearly 5 1/2%. Buffett didn't have to anticipate any change in the interest rate; by laddering his Bills, he rolled over his older low-interest bills to the newer high-interest bills as the old bills matured. The same will be true if and when interest rates are lowered.

But if all of this seems like too much work or if it's above your budget (you'd probably need about $10k on each step of the ladder), then I'd suggest any of a number of Money Market Funds (Buffett would recommend Government Money Market Funds), savings Accounts, or CDs at a solid bank. Check out bankrate.com for an up-to-date list of the best savings accounts.

The Macro View

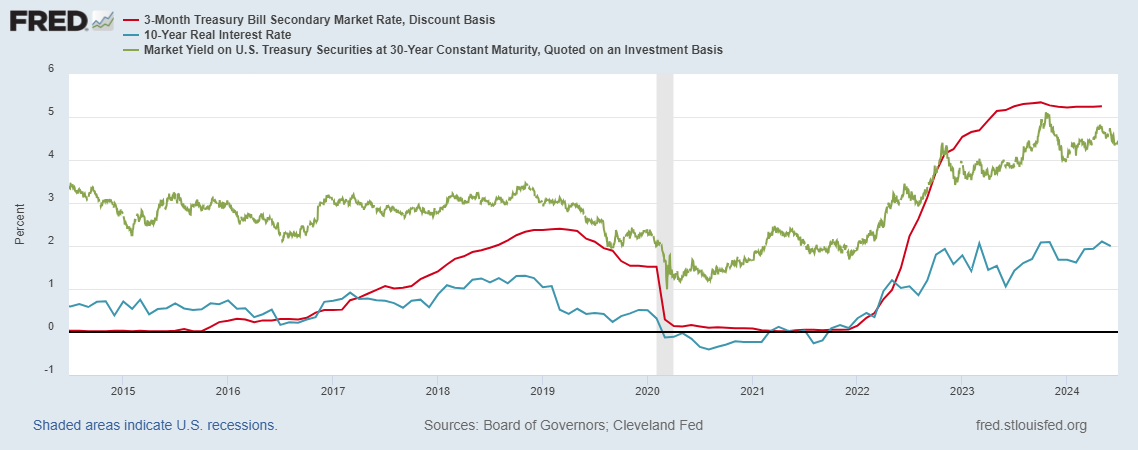

Interest-rates for 3 month T Bill (red), 5 year Treasury Note, and 10 year Treasury Note. Normally T Bills have the lowest interest rate (shortest maturity). Currently the Yield Curve is inverted, this has usually meant a slowing economy ahead (and lower interest-rates).

**

A note about Wall Street's current view of interest rates: I've included a chart of three maturities of 3-month T Bills, 5-year T Notes, and 30-year T bonds. You'll notice that the interest rate of the 3-month T Bill took off in 2022. This is when the Federal Reserve raised interest rates to fight inflation. As a consequence, for the last two years, the interest rate on the T Bill has been higher than the Bond or Note.

In Wall Street's parlance, the Yield Curve is now inverted. Interest rates are not as they should be. Longer maturities should have higher, not lower, interest. To the Street, this is a sure sign that the economy will slow, and eventually, interest rates will come down. So far, the Street has been wrong about that. They thought the Fed would reduce rates four times this year. But, the Fed has stood pat so far, missing the first two rate declines.

Most Wall Street analysts still believe that the Fed will lower rates, perhaps once this year and a couple of times next year. If they're right, then this might be the opportune time to capture these higher interest rates before they fall.

**

I hope this has given you a basic framework for how Warren Buffett and Wall Street approach cash management.

**

Current Rates

T Bills 5.10% - 5.48% (1)

CDs 2.5% - 5.4% (2)

Savings Accounts 1% - 5.25% (2)

Money Market Funds 2.5% - 5.30% (2)

(1) (https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202406)

(2) (www.bankrate.com)