The Strange Ritual of the Federal Reserve

I encourage the rest of us to linger a moment on these 14 words because they hold the key to understanding not only the Federal Reserve but also the exercise of power in our federal system.

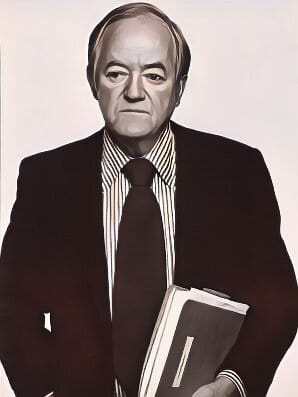

This past Friday afternoon, Chairman of the Federal Reserve, Jerome Powell, took to the podium to deliver his annual address from the Jackson Hole, Wyoming Symposium. This, along with his biannual testimony before the US Congress, is one of his three or four most important speeches of the year.

In what has become a ritual, the Chairman once again repeated his often-stated sentiment that:

“Our objective has been to restore price stability while maintaining a strong labor market…”

https://www.federalreserve.gov/newsevents/speech/powell20240823a.htm

Just 14 words long, this preface will likely be skipped over by most people. Indeed, Wall Street is waiting to hear what Powell said concerning the direction of future interest rates, so they brush through this and move on to later in the speech. Spoiler alert: Powell indicates, at least according to Street’s thinking, that lower rates are ahead, perhaps as soon as their September meeting.

But while traders and portfolio managers were anxious to set their next positions based on Powell’s remark, and so they’ve likely left our discussion, I encourage the rest of us to linger a moment on these 14 words because they hold the key to understanding not only the Federal Reserve but also the exercise of power in our federal system.

Although he has spent almost all of his career in finance, Jerome Powell is a lawyer, having graduated from Georgetown University Law Center in 1979. True to form, Powell lays out almost all of his public addresses like a legal brief, first outlining the legal principles/precedence for his argument, then detailing the Fed’s actions in compliance with those principles, and finally ending with whether their actions were successful.

On Friday, as he does almost ritualistically, Powell unveils the Fed’s “Dual Mandate” of stable prices and a strong labor market. It is no off-the-cuff comment by Powell but instead a careful recitation of the Federal Reserve’s primary responsibility as established by law.

Just which law and how we got there is a fascinating story, one that reveals an ongoing conflict between the country’s elites and the general populace.

The 1970s

The origin of this ritually repeated statement (the Dual Mandate) began in the 1970s. It is a time that is most often compared to our current era. It was in the 70s that the term “Stagflation” was invented by economists to explain that dreadful combination of high unemployment and high inflation, something that economists did not believe could exist. Before the 70s, most economists thought that high unemployment, with its concomitant slow economist, would naturally lead to low, not high, inflation. But, as anyone who lived through that decade will attest, in the 70s, we achieved that dubious “goal.”

Stagflation hit the heartland of America hard; stores and businesses declared bankruptcy, farms were foreclosed, and workers were laid off. Every day, Americans looked for someone to blame, and, at the time, a prime target was those “North East Elites,” a term I heard frequently.

After all, the Northeast, New York, Boston, and Philadelphia held most of the banks and nearly all of the investment firms in the country. And it was those same financial houses that were foreclosing on the farms, calling the loans, and perceived as driving down the stock market (the decade of the 1970s saw one of the worst bear markets of all time).

Wall Street wasn’t the only place crowded with elites; Washington had its fair share. Over in the Diplomatic Corps was one of the bluest of blue bloods, Henry Cabot Lodge. He was an heir to two of the most prominent New England families, the Cabots and the Lodges. He was the Grandson of a US Senator and the Great-Grandson of a Secretary of State. Lodge defined the political elite in America.

You may be familiar with the famous joke, “The Cabots only speak to the Lodges, and the Lodges only speak to God.”

At the same time Ambassador Lodge was serving in the State Department, the Vice President of the United States was none other than Nelson Rockefeller, grandson of the one-time richest man in American History, John D. Rockefeller.

The elites had a lock on politics and finance in the 1970s.

Hubert Horatio Humphrey

On the other side of the political and financial spectrum came a populist politician with the euphonious name of Hubert Horatio Humphrey. As cheery and upbeat as his name, here was a true populist, a “man of the people.” In fact, he founded a party whose name encapsulated his constituents: the Democratic-Labor-Farmers Party of Minnesota.

Although he began his career with all the fervor of a Washington outsider, three decades in Washington left their mark. As Vice President to Lyndon Johnson, Humphrey was a full-throated supporter of the increasingly unpopular Vietnam War.

By the late 1970s, the old warhorse was ready to reestablish his populist credentials. Along with California Congressman August Hawkins, Humphrey proposed that the US Government should aim to provide for full employment and balanced economic growth. For over 30 years, the Government had been operating under the goals of the Employment Act of 1946. An act which, although it promoted full employment, said nothing about balanced growth.

Humphrey proposed that the country's principal economic objective should be to slay the twin financial dragons of the 1970s: high unemployment and high inflation.

Since its passage by the 95th Congress and signed into law by President Jimmy Carter on October 27, 1979, the Full Employment and Balanced Growth Act has been the law of the land. It applies not just to the Federal Reserve but to all Departments and Agencies of the US Government. From the US Treasury to the Internal Revenue Service to the Environmental Protection Agency, it aims to promote employment and stable prices.

https://www.govtrack.us/congress/bills/95/hr50

Unfortunately, our elected representatives rarely speak about their responsibilities to uphold these twin goals. To his credit, Chairman Jerome Powell recites his responsibility with nearly every speech he delivers. It’s a ritual worth keeping.

PS In a future article, we will explore the positives and limitations of the Full Employment and Balanced Growth Law.

**